[property-carousel]

Invown Makes Fundraising and Investing Seamless

Invown is a two-sided marketplace that enables issuers to sell securities in real estate and other income-generating assets, and anyone over the age of 18 to participate in the same high quality deals as institutional investors. We’re helping fundraisers bring exciting and innovative projects to life while creating generational wealth-building opportunities for everyone.

Invown for Issuers

With Invown, issuers of securities in real estate and other income-generating assets can legally raise funds from a wider pool of investors, including non-accredited investors, and maximize their marketing impact.

Invown for Investors

Invown opens the door to institutional-grade securities offerings for all investors. As an SEC-registered Funding Portal, we ensure investor protection and provide a seamless investing experience for everyone, regardless of accreditation status.

Invown for Owners, Sponsors, Operators, and Syndicators

Invown is an SEC-registered and FINRA-approved Funding Portal, specializing in real estate and other income-generating asset offerings. We enable you to secure project financing from accredited and non-accredited investors, as well as specialist debt providers.

Everyone can invest – maximizing marketing efforts

Expand your investor base by allowing non-accredited investors to invest in your deal. You set the minimum investment amount.

All legal documents supplied – saving you thousands

Invown provides tailored legal documents for business formation and investment needs, including LLC agreements, Investment Agreements, and Form C.

Cutting edge tech – seamless investor and sponsor experience

Invown’s platform offers a simple, delightful experience for sponsors and investors, including features like investor dashboards and sponsor analytics.

Invown for Investors

Everyday investors gain exposure to real estate and other income-generating assets by investing as little as $500

Low Barrier to Entry

Passive Investments

Nationwide

Diverse Markets

Invest from as little as $500. No deposit requirements and no maintenance fees.

Investors are passive and therefore not directly responsible for maintenance, property management, or tenants.

Companies listing on Invown are from all around the country. Pick the markets that suit your expectations best!

Build a diverse and tailored investment portfolio with exposure to real estate and other income-generating projects.

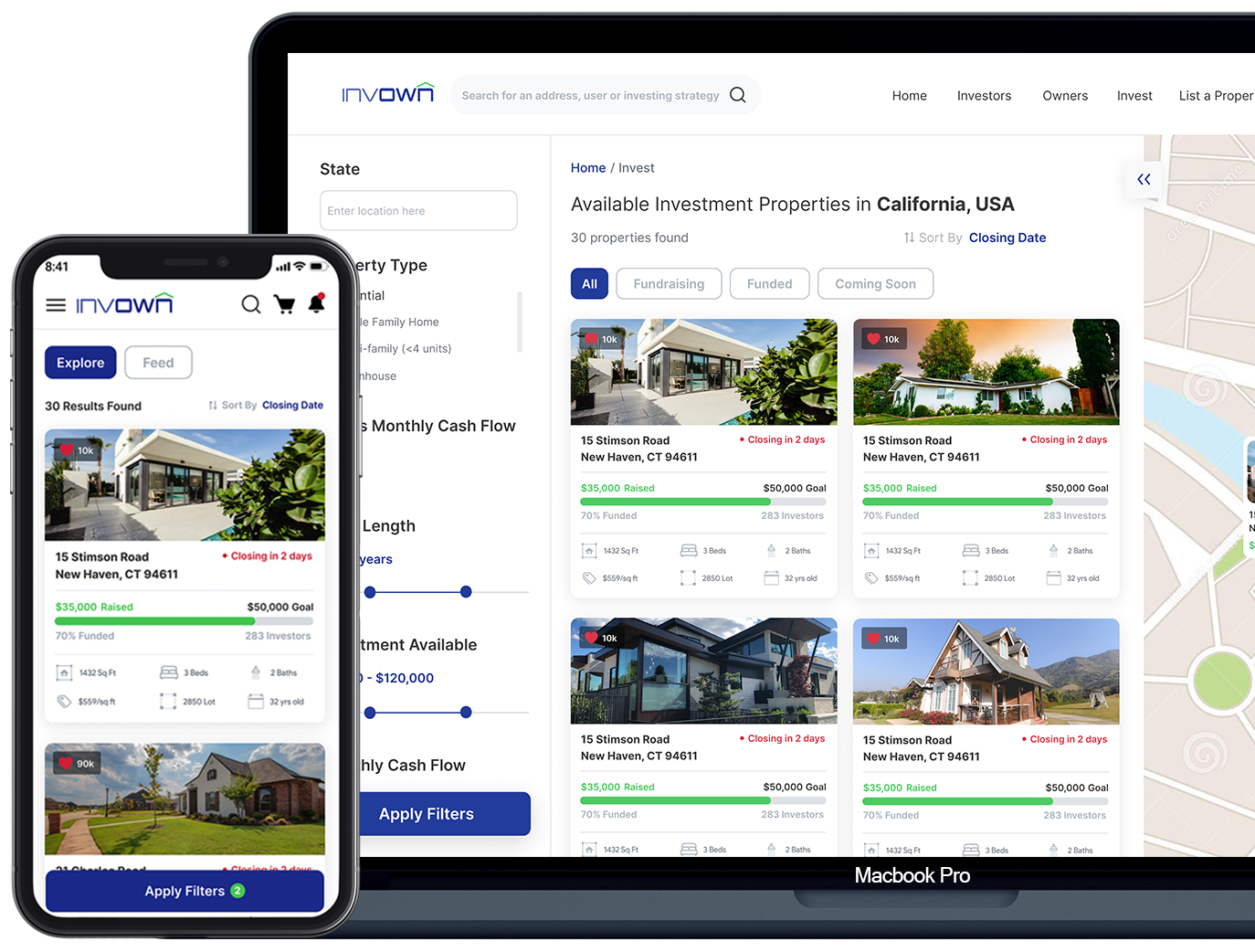

Browse and filter offerings from around the country

When you log into Invown, you’ll be greeted by real estate and other income-generating projects from around the country.

Residential and Commercial Companies

Find an investment that meets your specific interests.

Short or Long Term

Owners offer short and long term investment opportunities.

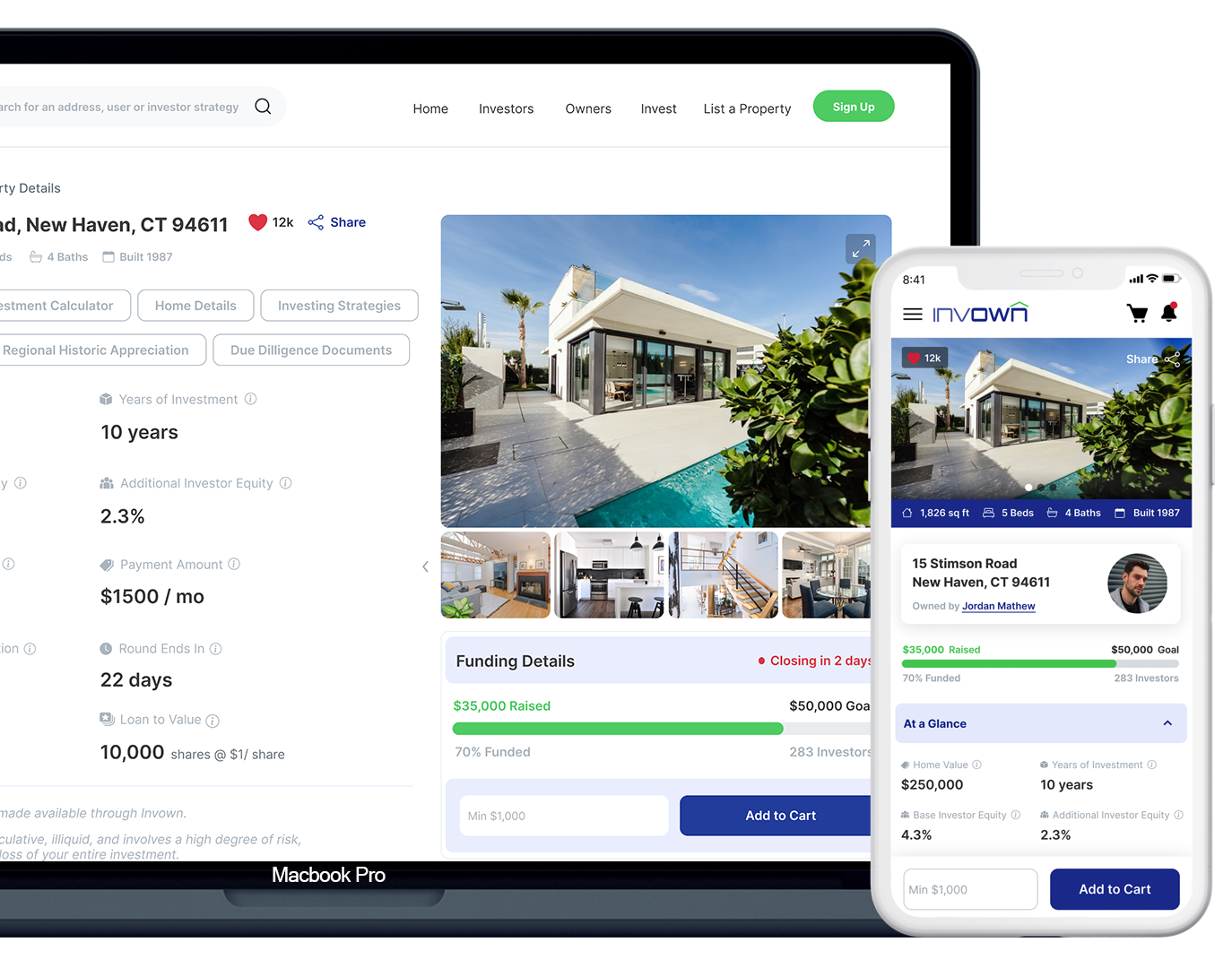

Dive into each investment, then add it to your cart!

Compare each investment opportunity and dig deep into the offering terms and return potential.

Detailed Investment Information

Investment listings provide necessary due diligence information and the ability to ask the issuer questions, so that investors can make informed investment decisions.

Add your investment to cart!

Browse diverse investment opportunities and add them to your cart to check out in minutes.

What am I investing in?

When you invest through Invown, you’re investing in real estate and other income-generating projects via Regulation Crowdfunding.

Understand The Benefits

By passively investing in a company that owns real estate and other income-generating projects, you gain exposure to project value and potential cashflow, without the headaches of direct ownership.

The Risks

Investments offered on Invown are illiquid and, like all privately bought securities, contain inherent risk. Investors can lose the entire value of their investment. In addition, investments on Invown are highly speculative. Never invest more than you can afford.

Return on Investment

Invown cannot predict any potential return on investment. You need to review each property upon which the security or interest is based and decide if the potential risk/reward is worth the investment.